The collapse of Terra/Luna in 2022 wiped out an estimated $40 billion in value, triggering panic across global crypto markets and impacting thousands of investors worldwide.

The sentencing comes after years of investigations by international regulators and law enforcement agencies.

How the Terra/Luna Collapse Happened

Terra/Luna was once considered a major player in the crypto space.

A rapid loss of confidence triggered mass withdrawals, causing UST to lose its dollar peg. Luna’s value crashed, leading to catastrophic losses for investors. The event caused widespread fear, leading to a temporary crash across global cryptocurrency markets.

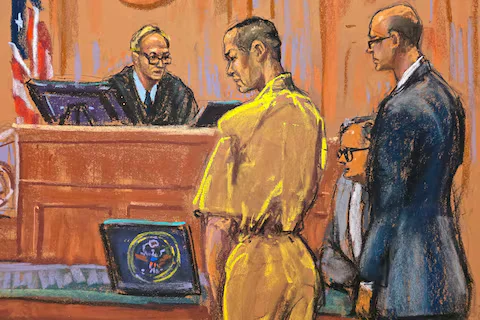

Legal Proceedings Against Do Kwon

Isdictions. Investigators accused him of misleading public statements and fraudulent promotion of Terra/Luna tokens. Authorities argued that Kwon prioritized rapid expansion over transparency and financial responsibility.

The recent sentencing of 15 years in prison reflects the severity of the case. Legal experts say it sets a precedent for accountability in the cryptocurrency sector, signaling that even founders of decentralized projects can face severe consequences.

Impact on Investors and the Crypto Market

The Terra/Luna collapse caused substantial financial losses.

Analysts have discussed these reforms in cryptocurrency risk management frameworks, highlighting how lessons from Terra/Luna are shaping future crypto governance.

Lessons for the Crypto Industry

The sentencing of Do Kwon underscores the importance of transparency, regulation, and risk management in the cryptocurrency industry.

The Terra/Luna collapse demonstrated that algorithmic mechanisms are vulnerable to market volatility and investor panic. Companies developing crypto products are now focusing more on compliance, auditing, and liquidity management to prevent similar crises.

Regulatory Changes and Global Oversight

The fallout from Terra/Luna prompted global regulators to increase oversight of digital assets. Governments in the US, EU, and Asia proposed new legislation aimed at protecting investors and ensuring transparency. This includes stricter reporting standards, mandatory audits for stablecoin issuers, and clear legal accountability for founders and executives.

Do Kwon’s sentencing demonstrates that regulators are now willing to enforce the law against high-profile crypto figures.

What This Means for the Future

The Terra/Luna incident and Do Kwon’s conviction may reshape investor behavior. Confidence in algorithmic stablecoins has declined, and many crypto projects are now prioritizing stability over rapid growth.

For the broader crypto market, this case serves as a cautionary tale. The industry is entering a new era where accountability, transparency, and regulatory compliance are essential for long-term success.

Final Thought

Do Kwon’s 15-year sentence marks a historic moment for cryptocurrency regulation. It sends a strong message: founders cannot escape responsibility, even in decentralized systems.